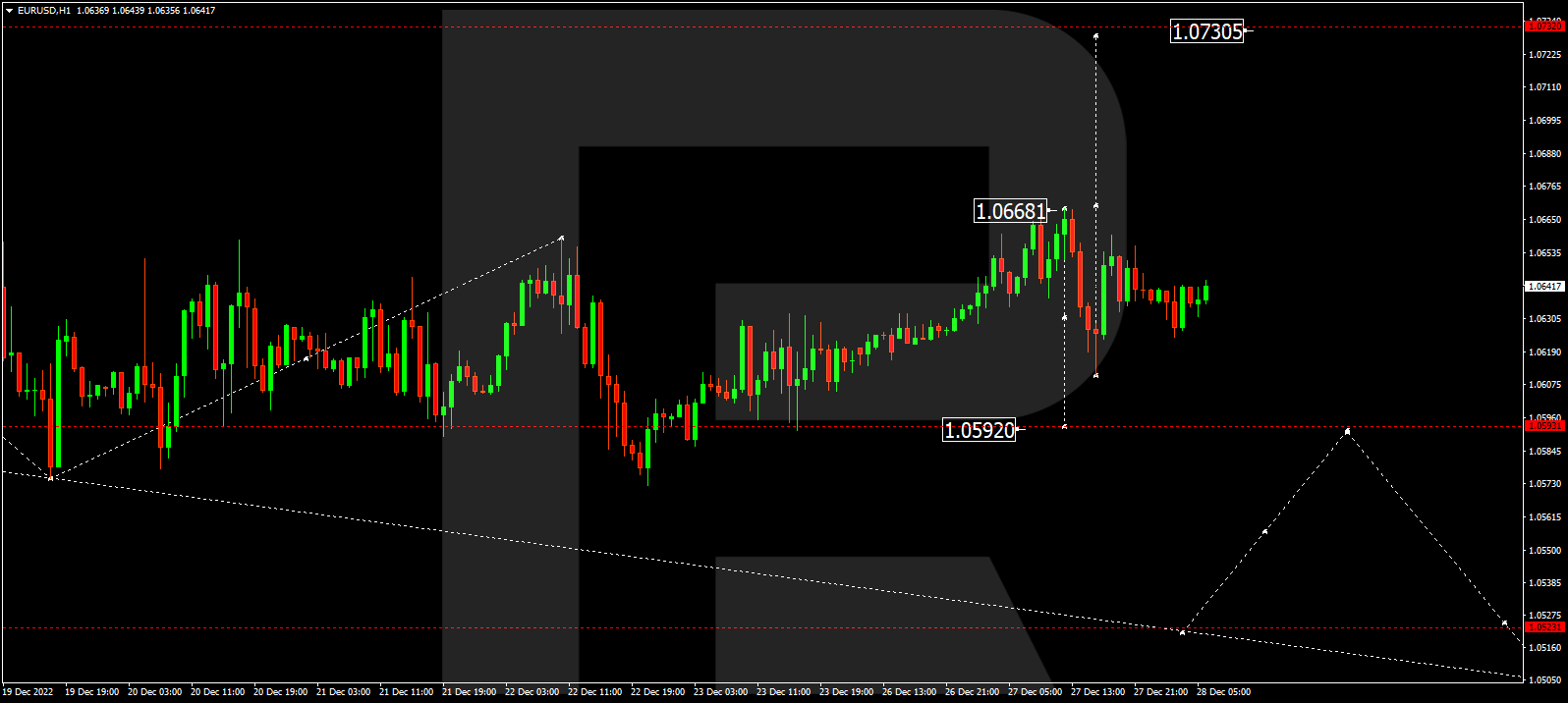

EUR/USD, “Euro vs US Dollar”

The currency pair completed an impulse of decline to 1.0611 and a link of correction to 1.0659. Practically the market has set the borders of a consolidation range. With an escape upwards, a pathway to 1.0730 will open. With an escape downwards, the wave might extend to 1.0592. And if this level gets broken as well, a pathway down to 1.0520 might open, followed by a correction to 1.0600 (a test from below) and a decline to 1.0460. The goal is first.

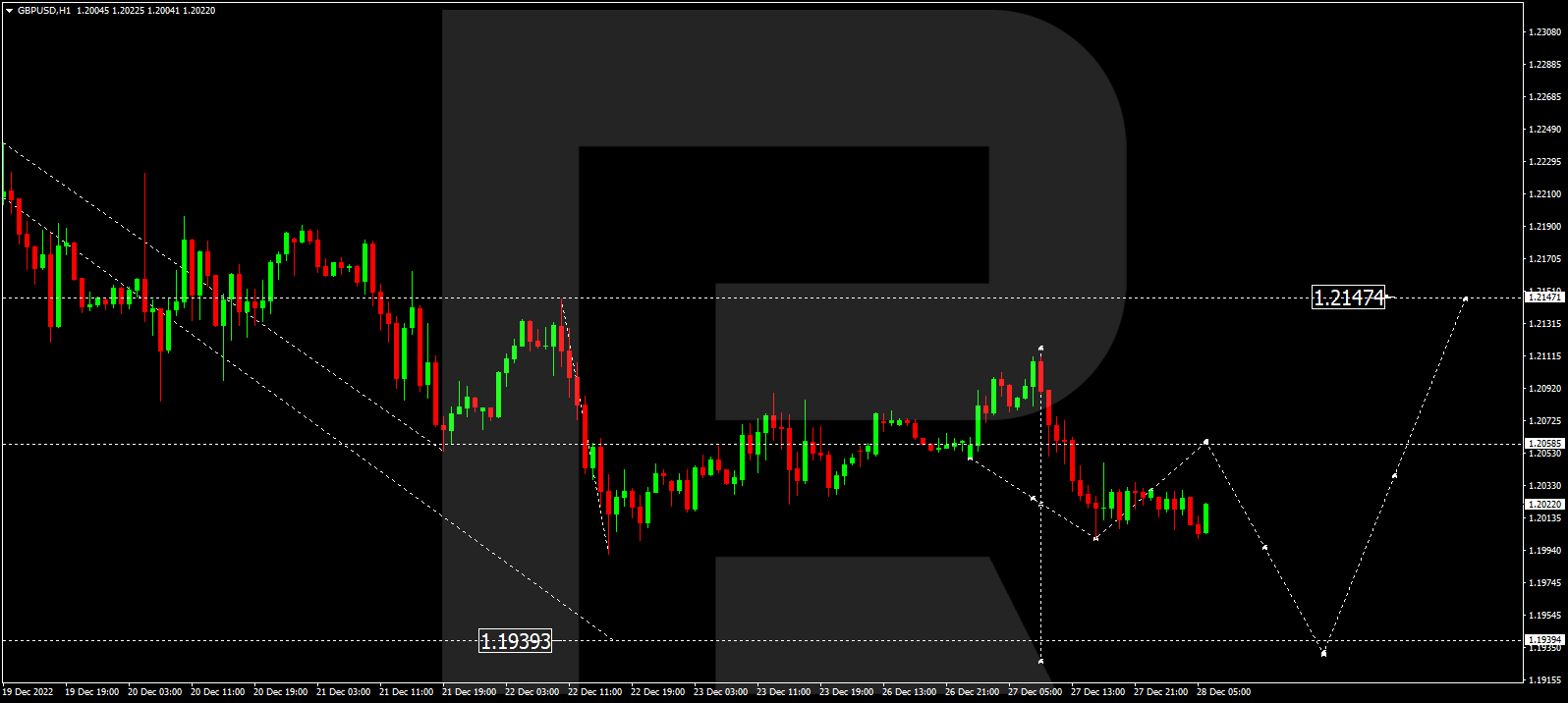

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair completed an impulse of decline to 1.2002. A link of correction to 1.2058 is not excluded today. After this level is reached, the pair may decline to 1.1940, correct to 1.2140, and fall to 1.1850. The goal is first.

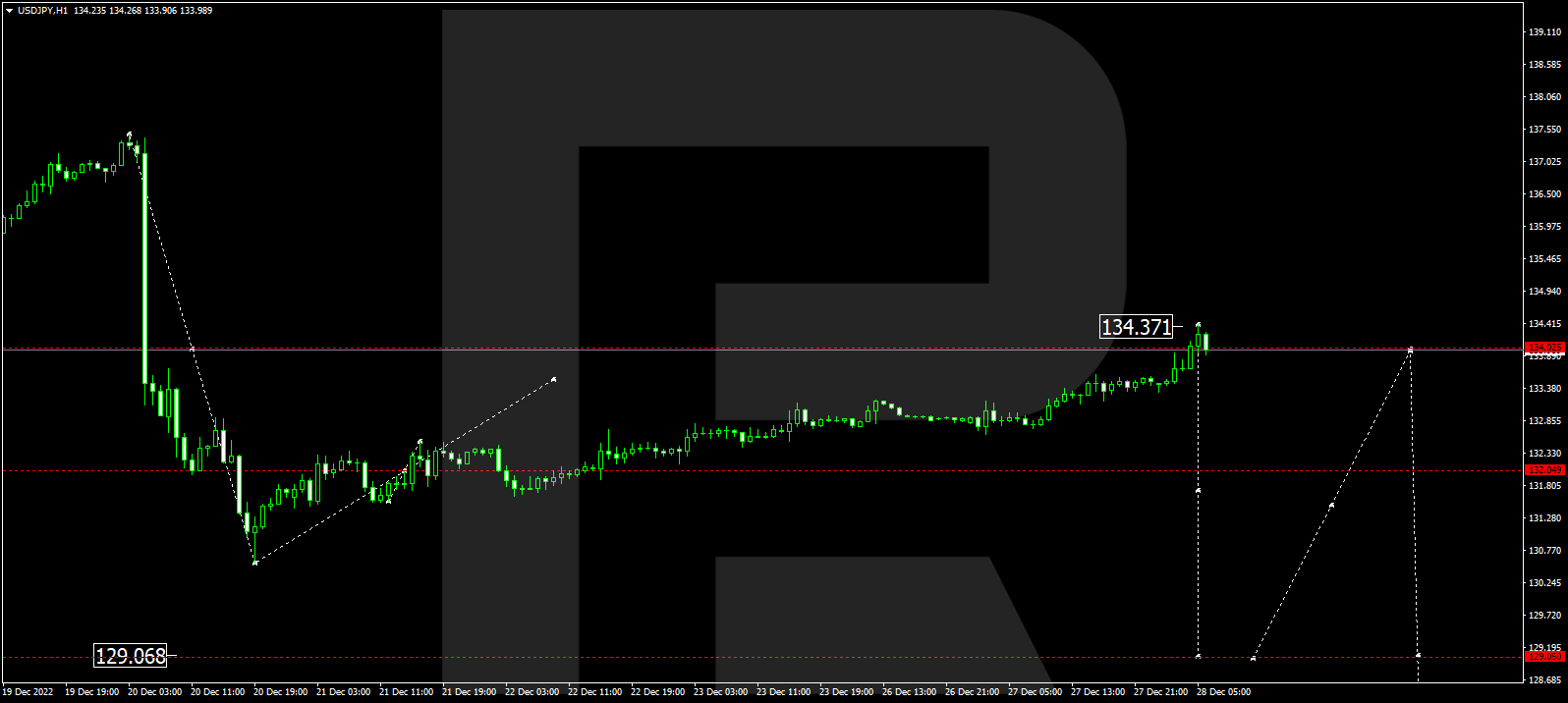

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair completed a wave of growth to 134.37. Today a consolidation range may develop under this level. With an escape downwards, a pathway to 132.00 will open. And if this level is broken away as well, a decline to 129.00 will become possible. The goal is first.

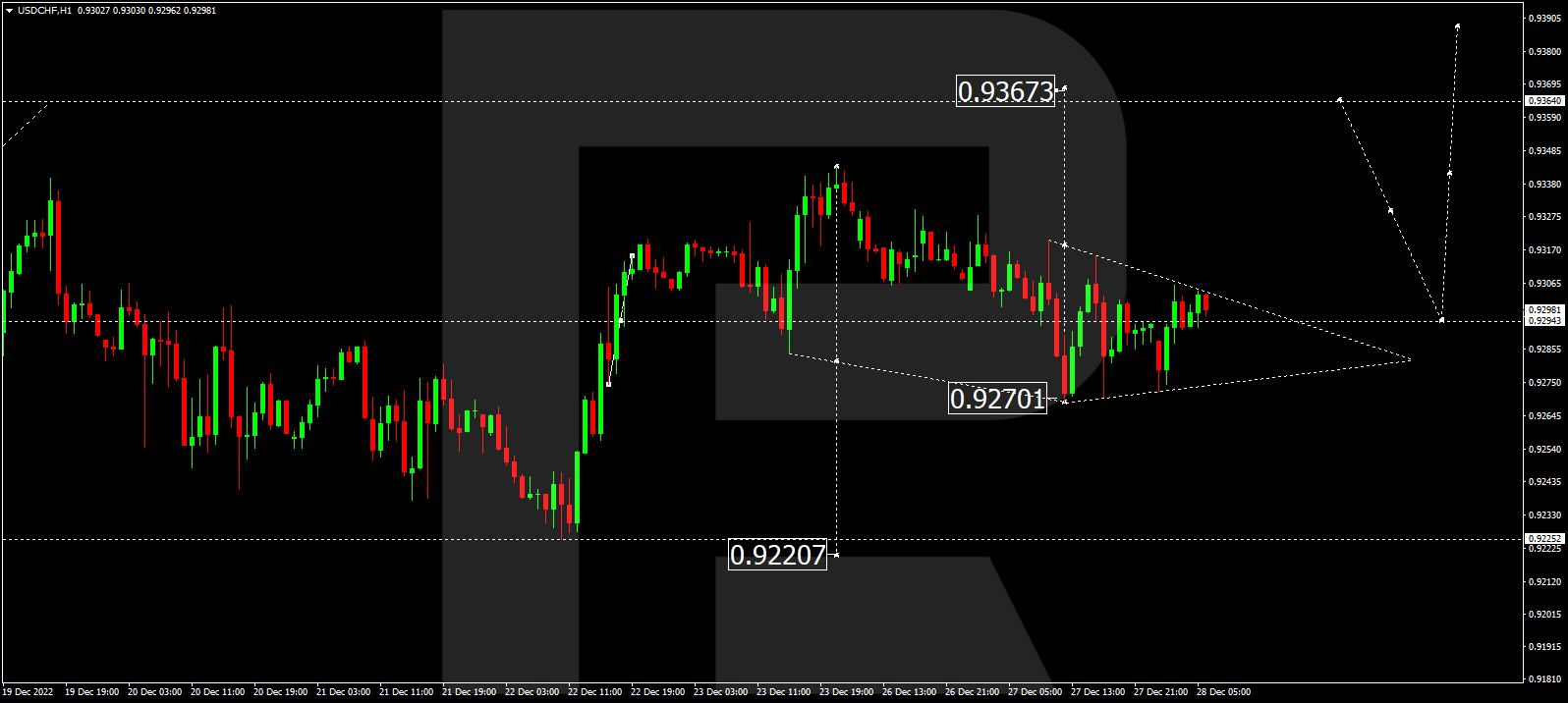

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair completed an impulse of growth to 0.9315 and a correction to 0.9272. Practically, a consolidation range has formed at these levels. With an escape downwards, a pathway to 0.9222 will open. With an escape upwards, the wave of growth might continue to 0.9366. The goal is first. Then the quotes may fall to 0.9292 and grow to 0.9400.

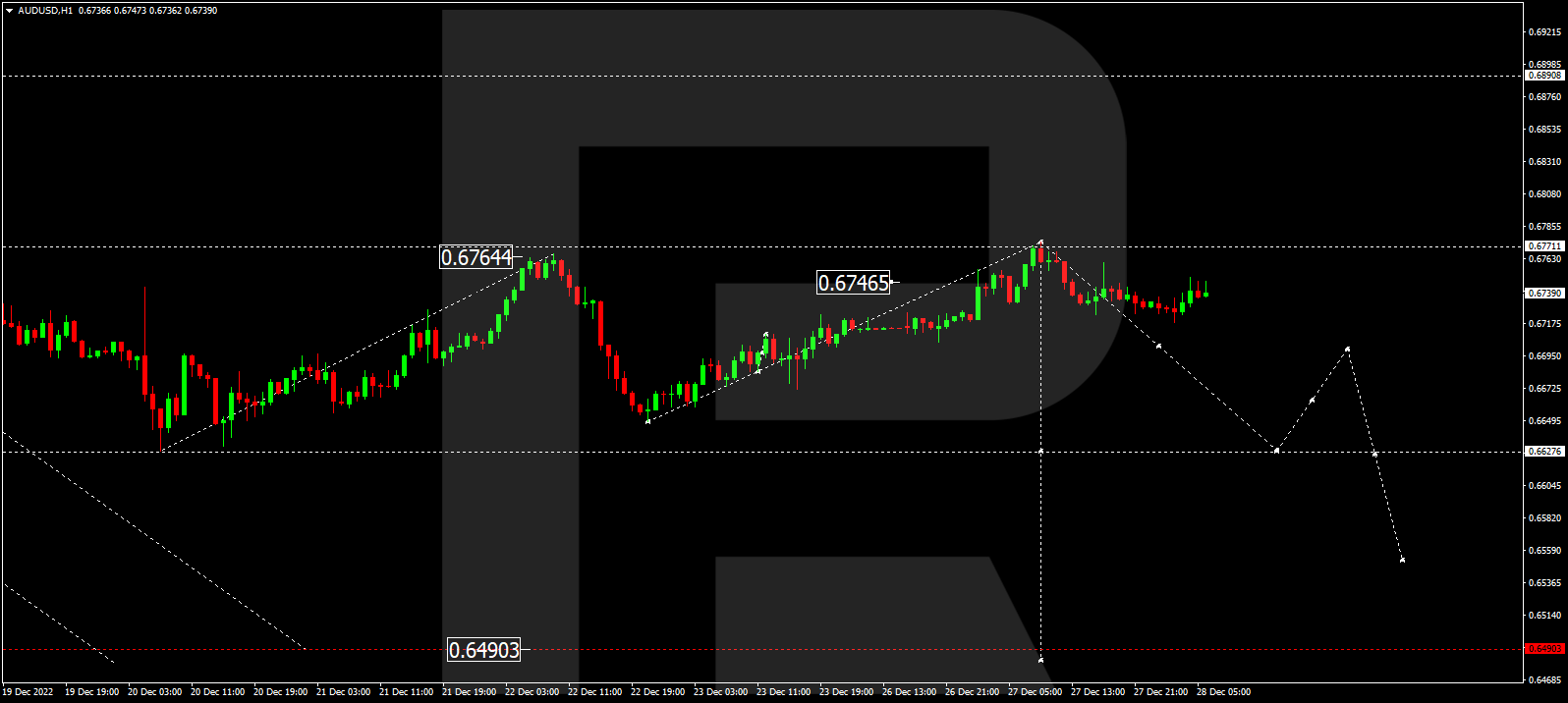

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair completed a wave of growth to 0.6771. Today a wave of decline to 0.6700 should start, from where the trend might continue to 0.6630.

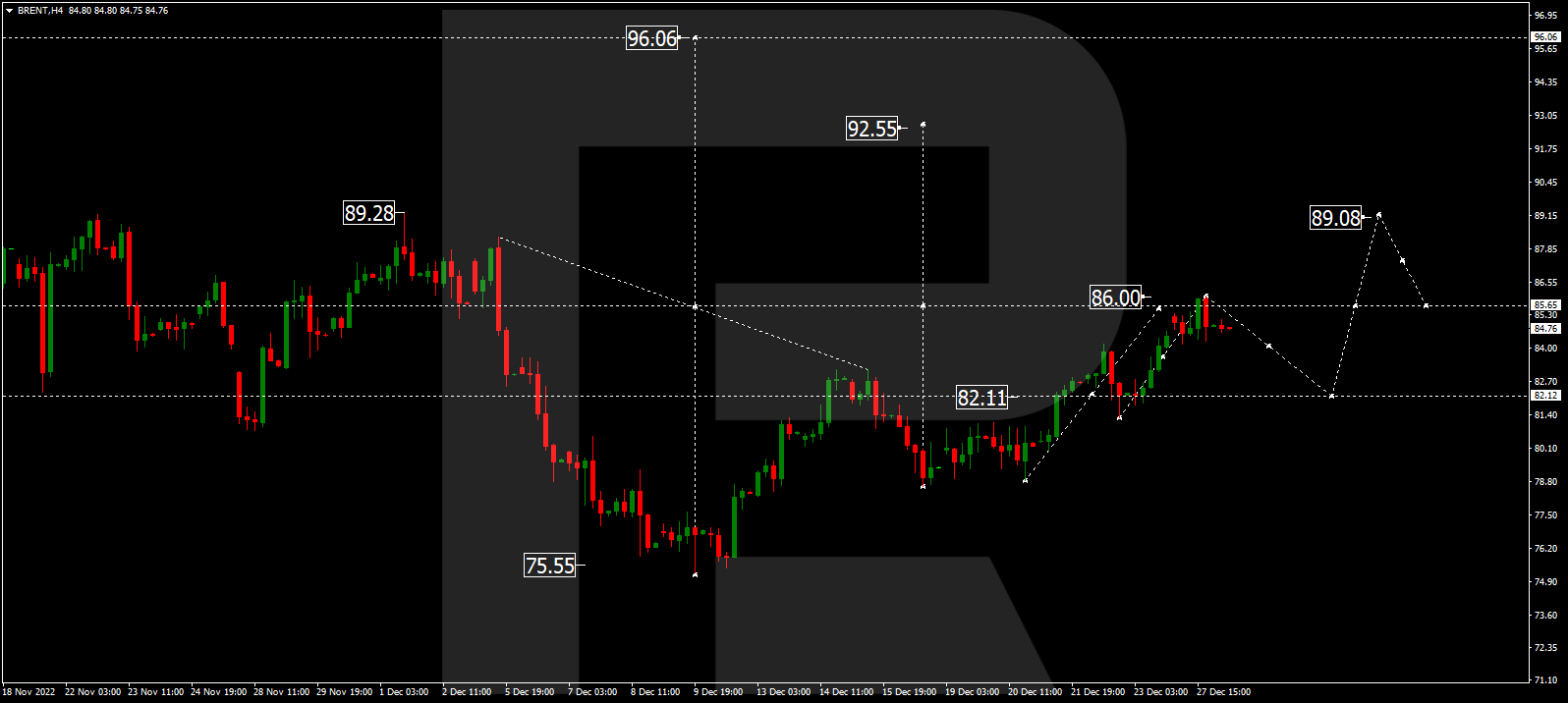

Brent

Crude oil has completed an impulse of decline to 84.50. At the moment, the market is forming a consolidation range above this level. With an escape downwards, the correction might continue to 82.11. After this level is reached, a link of growth to 89.00 is expected, from where the trend might continue to 92.55. The goal is local.

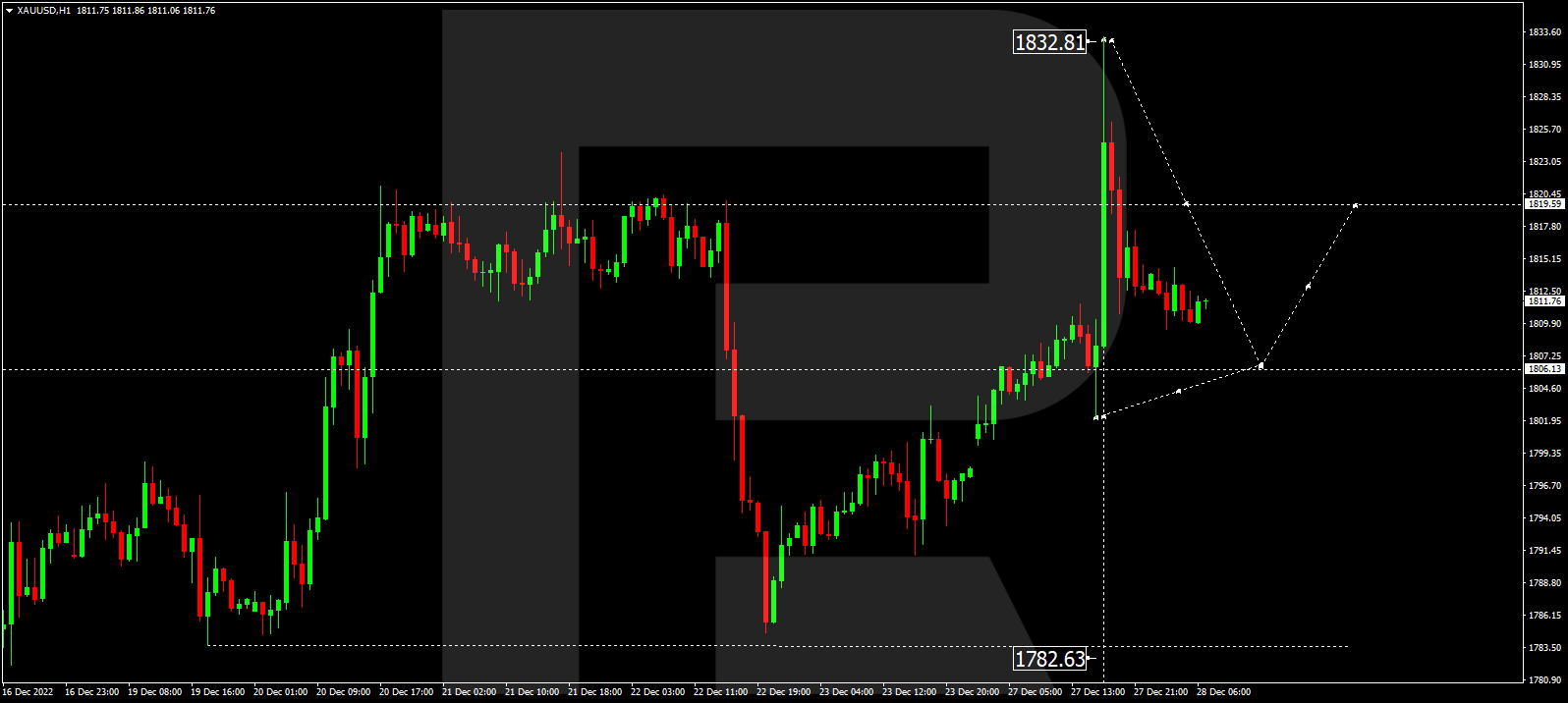

XAU/USD, “Gold vs US Dollar”

Gold completed a wave of growth to 1832.80. Today the market is forming an impulse of decline to 1806.10. After this level is reached, growth to 1819.60 is expected, followed by a decline to 1800.00, from where the trend might continue to 1770.00.

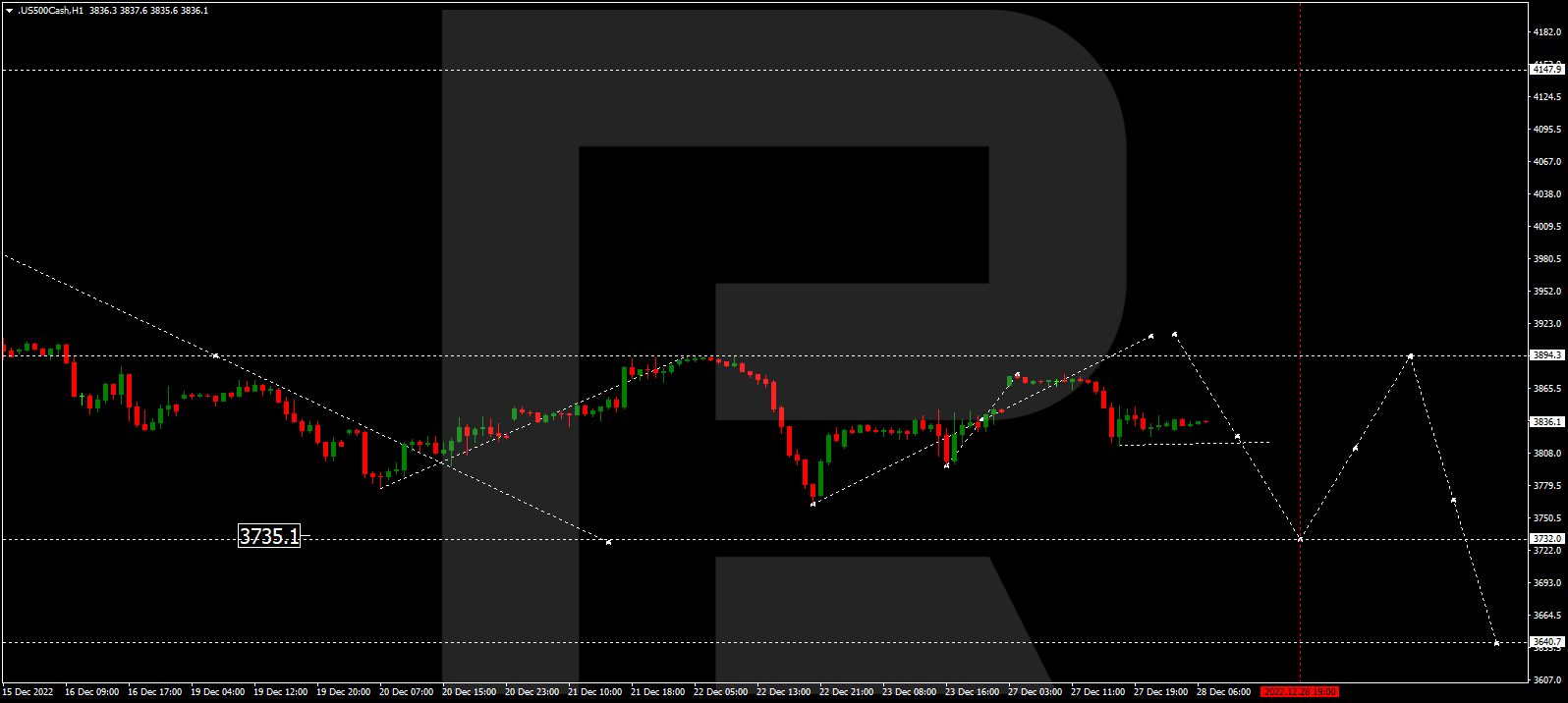

S&P 500

The stock index has completed an impulse of decline to 3810.0. Today a consolidation range is forming around this level. With an escape downwards, a pathway down to 3732.0 will open. The goal is local. With an escape upwards, a link of growth to 3900.00 is not excluded, followed by a decline to 3732.0.

Read More:Forex technical analysis and forecast: Majors, equities and commodities

2022-12-28 08:14:50