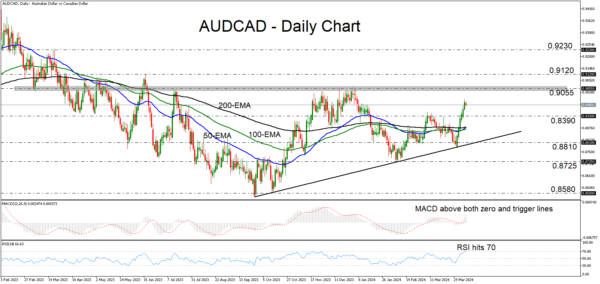

- AUDCAD rallies after hitting uptrend line

- RSI and MACD detect positive momentum

- A break above 0.9055 could shift the outlook to clearly bullish

- But a dip below 0.8810 could invite more bears

AUDCAD has been trading in a rally mode since April 2, when it hit support at the near-term uptrend line drawn from the low of September 27. On April 5, the pair emerged above the 0.8930 resistance (now turned into support) zone and looks to be headed towards the key obstacle of 0.9055.

Both the MACD and the RSI are detecting upside speed, corroborating the notion for some further advances, perhaps until the 0.9055 zone. The former is lying above both its zero and trigger lines pointing up, while the latter is near its 70 line. That said, the RSI ticked down after hitting 70, which implies that a minor pullback may be looming before the next leg north, perhaps to challenge the 0.8390 zone as support this time.

Should the bulls remain in the driver’s seat, a test of the 0.9055 barrier might not take long to happen. Nonetheless, for the outlook to be considered clearly bullish, a decisive move above that area may be needed. Such a move may initially target the high of June 16, 2023, at around 0.9120, the break of which could extend the rally towards the high of March 22, 2023, near 0.9230.

On the downside, a dip below 0.8810 could also signal the break below the aforementioned uptrend line. The sellers could then get encouraged to aim for the 0.8725 region, the break of which could carry larger bearish implications and perhaps pave the way towards the low of October 13 at 0.8580.

Summarizing, AUDCAD rebounded strongly after testing the uptrend line drawn from the low of September 27. However, the move that could shift the outlook to clearly bullish may be a decisive break above 0.9055.

Read More:AUDCAD Rebounds Strongly from Uptrend Line

2024-04-10 12:24:53