ROAD TOWN, British Virgin Islands, April 01, 2024 (GLOBE NEWSWIRE) — Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) (“Aura” or the “Company”) is pleased to report updated Mineral Reserves and Mineral Resources (“MRMR”) for its four operating mines: Aranzazu Mine, Apoena Mines (formerly known as EPP), Minosa Mine (also known as San Andres) and Almas Mine, as well as its development projects including Borborema, Matupá as reported in the Annual Information Form for the year ended December 31, 2023 (“2023 AIF”). Readers are encouraged to read the 2023 AIF and Technical Reports (as defined herein), which have been filed on SEDAR+ at www.sedarplus.ca. Consolidated MRMR tables are noted below.

Rodrigo Barbosa, President and CEO of Aura commented, “We are excited to announce our latest Mineral Resources and Reserves (MRMR) update across our operations, marking an impressive increase across all categories, adding 2.4moz in M&I Resources and 856koz in P&P Reserves. This achievement is a result of our clear strategy to increase production while we increase our Resources and Reserves. In 2023, we published a new Feasibility Study on Borborema, which adds, for the moment, 83koz per annum in production during the first 4 years while it increases our Reserves by 814koz and 2.1mkoz on Resources. In addition, the probable relocation of the Federal Road at Borborema will unlock another significant amount of reserves. Furthermore, our efforts at Apoena have led to the largest reserves increase since 2017, when Apoena had 3 years of LOM; we operated for 7 years and now have a 5-year LOM. As an example, our efforts at Apoena have led to the largest reserves increase since 2017, when Apoena had 3 years of LOM; since then we operated for 7 years and now have a 5-year LOM. Another important example of our exploration success is Aranzazu, where we started production in the end 2018 with a 5-year LOM, operated for more than 5 years, increased capacity by 30%, and now have an 8-year LOM. With these successes and the significant expansion potential remaining at all our assets, we remain committed to prioritizing increasing exploration to create value for shareholders in the years to come.”

2023 AIF Highlights:

- Aura completed another robust exploration program totaling 114,074.37 meters of drilling with over US$24 million invested to increase MRMR and replace depleted ounces. Exploration efforts were conducted across all properties with the exception of Minosa, due to increased efforts on operating performance. Exploration is expected to resume at Minosa in 2024.

- Important contributions toward increased MRMR included the addition of the Borborema Project, following the completion of the previously announced feasibility study in August 2023 and significant growth at Apoena Mines, which saw its largest increase in Mineral Reserves in its operating history since 2017.

- Proven & Probable (“P&P”) Mineral Reserves increased 32% with 1.2M GEO added (before depletion). At the four operating mines, an increase of approximately 856k GEO (before depletion) exceeded 2022 depletion on a consolidated basis, with a net increase in P&P Reserves at Apoena, Aranzazu and Almas. Approximately 812k GEO was attributed to the Borborema Project.

- Measured & Indicated Mineral Resources increased 49% with 2.4M GEO added (before depletion/conversion). More than 100% of depleted metals were replaced at each of the sites with the exception of Minosa.

- Inferred Mineral Resources increased 27% with 221 kGEO added (after conversion), result of the addition of approximately 400k GEO attributed to the Borborema Project. The net reduction in Inferred Mineral Resources for the mines in production between 2022 and 2023 was primarily due to the successful conversion of Inferred Mineral Resources to M&I Mineral Resources at each of the sites with the exception of Minosa.

Additional Projects Updates:

- At the Serrinhas deposit, which is an exploration target at the Matupa project, a total of 12,026 meters were drilled in 43 holes, with exploration actively continuing in key targets in 2024. An updated Technical Report is anticipated before the end of 2024.

- At Serra da Estrela exploration Project (Aura Carajas), a total of 7,822.40 meters were drilled in 18 holes along a 5km strike to test mineralization continuity identified in previous exploration by Anglo Gold. The Company expects to release drill results during 2024 with a potential Technical Report in 2025.

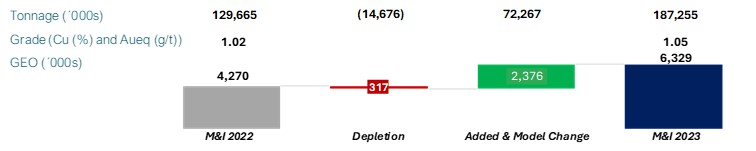

Aranzazu, Mexico

At Aranzazu, the primary focus for infill drilling has been at the Glory Hole Zone (“GHZ”). The Company also focused on the new BW connection (“BWZ”), Cabrestante and Ezperanza zones. In 2023, a total of 24,840.65 meters of drilling were completed with the goal of converting known inferred resources to indicated.

Changes in P&P Mineral Reserves included an increase of 0.6 million tonnes (6%), 62,975 GEO1 (7%) and 7% increase on the Net Smelter Return (“NSR”) due to higher copper and gold prices, compensating for 40% of 2023 depleted tonnes. The volume of the main ore body of Aranzazu was reduced by 6% due to depletion, after infill drilling and converting mineral resources to mineral reserves by the end of 2023. GHHW Zone had expanded after infill drilling by 36% and accounted for about 32% of the 2023 mineral reserve.

Changes in Mineral Resources include the conversion of 692,000 tonnes and 656,000 tonnes from Inferred to M&I Mineral Resources in the GHFW2 and GHHW3 zones, respectively. Approximately 481,000 tonnes were added to GHZ in the Inferred Resource category. Infill drilling in Cabrestante zone depleted 464,000 tonnes from Inferred Mineral Resources and converted approximately 76,000 tonnes to M&I Mineral Resources with grades increasing 5% for copper, 2% for silver and decreasing 6% for gold.

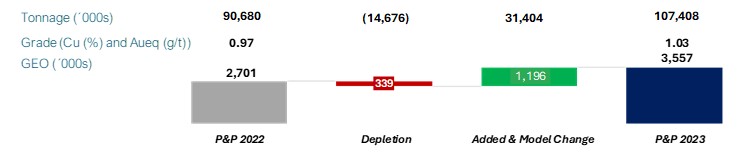

The charts below show changes in P&P Mineral Reserves, M&I Mineral Resources and Inferred Mineral Resources for the Aranzazu Mine as of December 31, 2023 compared to December 31, 2022.

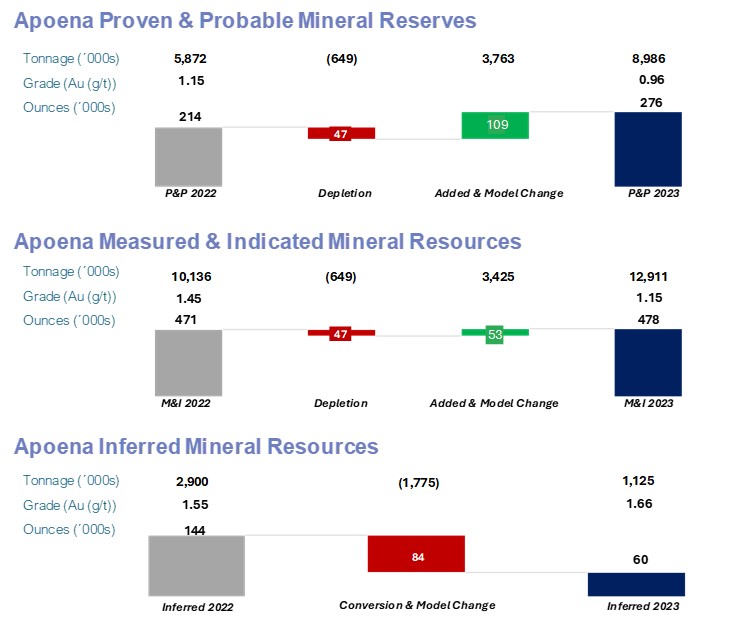

Apoena, Brazil

In a press release dated February 23, 2024, Aura announced updated MRMR for Apoena Mines, noting a significant increase in gold reserves, the largest since 2017. This growth supports an extension of the mine’s life for over five years based solely on current reserves.

The update follows extensive drilling in previous years, particularly at the Nosde and Lavrinha mines. Aura aims to further expand its exploration to enhance Inferred Mineral Resources and explore potential pit connections. The decrease in Inferred Mineral Resources resulted from infill drilling and conversion to Indicated category.

The charts below show changes in P&P Mineral Reserves Estimates, M&I Mineral Resources Estimates and Inferred Mineral Resources Estimates for Apoena as of December 31, 2023, compared to December 31, 2022.

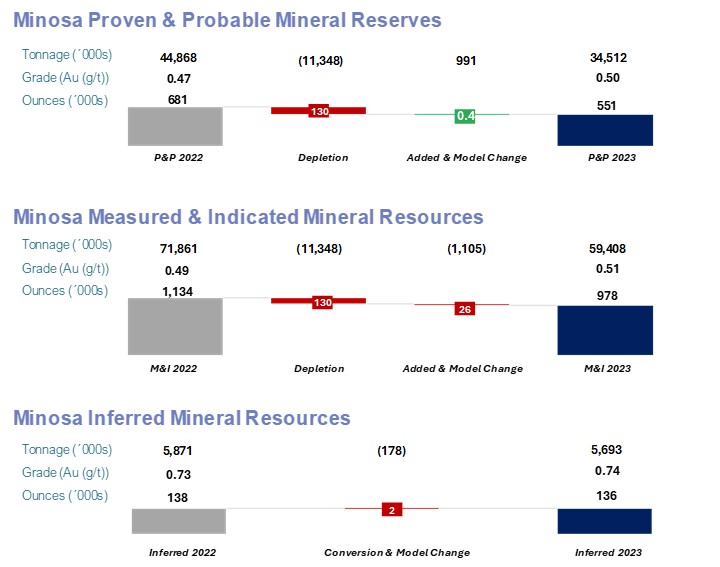

Minosa (San Andres), Honduras

Exploration activities during 2023 focused on exploration drilling to test continuity of historical sulfide high grade veins zone. A total of 1,987 meters of drilling was completed and more work is needed to better evaluate the potential of this area.

Mineral Reserves estimated by Aura total approximately 34.5 Mt in P&P Mineral Reserves at an average grade of 0.50 g/t Au. Mineral Resources estimated by Aura total 59.4 Mt of M&I Mineral Resources at an average grade of approximately 0.51 g/t Au and Inferred Mineral Resource of 5.69 Mt at an average grade of 0.74 g/t gold grade. The Mineral Resources pit shell optimization did not consider any sulphide material.

Exploration activities during 2023 focused on exploration drilling to test continuity of historical sulfide high grade veins zone in San Andres mine. A total of 1,987.50 meters were drilled in 7 holes and more work is needed to better evaluate the potential of this area. As we move forward, the coming years are poised for further exploration developments at Minosa. Exploration effort at Minosa is integral to our broader strategy for growth and value creation across our portfolio.

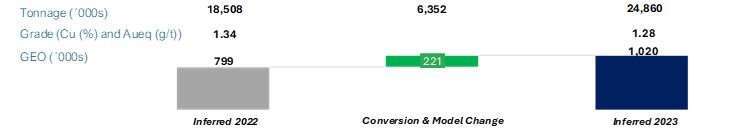

The charts below show changes in P&P Mineral Reserves Estimates, M&I Mineral Resources Estimates and Inferred Mineral Resources Estimates for Minosa as of December 31, 2023, compared to December 31, 2022.

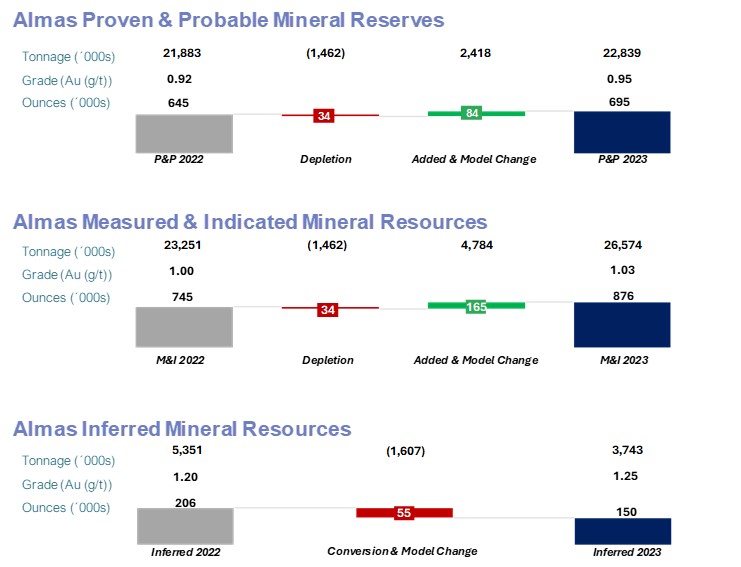

Almas, Brazil

Almas is the first greenfield project constructed by Aura and commenced commercial production in September 2023. Average annualized gold production is estimated at 51,000 ounces during the first four years, not including investments in expansion, which are currently under way. There is an estimated life of mine of 17 years, based on Mineral Reserves estimated in accordance with NI 43-101.

In 2023, exploration drilling activities at the Paiol deposit was focused on converting Inferred Mineral Resources to the Indicated category. A total of 15,482.55 meters were drilled. Infill drilling was executed at the Vira-Saia deposit, in the NW portion of the inferred body to convert Inferred Mineral Resources to the Indicated category.

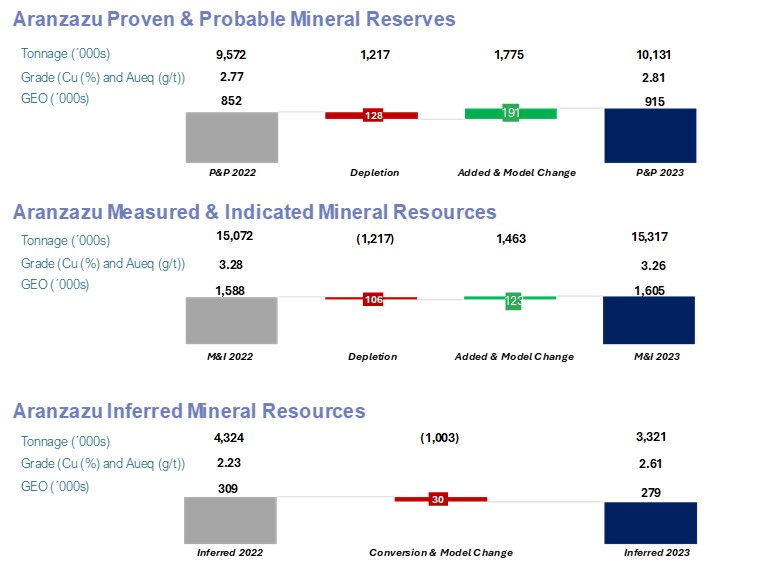

The charts below show changes in P&P Mineral Reserves Estimates, M&I Mineral Resources Estimates and Inferred Mineral Resources Estimates for Almas as of December 31, 2023, compared to December 31, 2022.

Borborema, Brazil

Aura completed a Feasibility Study in August 2023 which indicated anticipated production of 748,000 ounces of gold over an 11.3-year mine life, with possibilities for even greater output. Borborema also showcases a strong Mineral Reserve base, with Probable Mineral Reserves of 812,000 oz gold, and an extensive Mineral Resource profile with strong growth potential that consists of 2,077 koz of indicated Mineral Resources and 393 koz of Inferred Mineral Resources. Initial measures have already been undertaken to start obtaining permits to move the road, and upon its successful relocation, there exists the potential to convert in Mineral Reserves 1,265 koz of Indicated Mineral Resources into Mineral Reserves (exclusive of…

Read More:Aura Reports Updated Mineral Reserves and Mineral Resources

2024-04-02 00:44:21