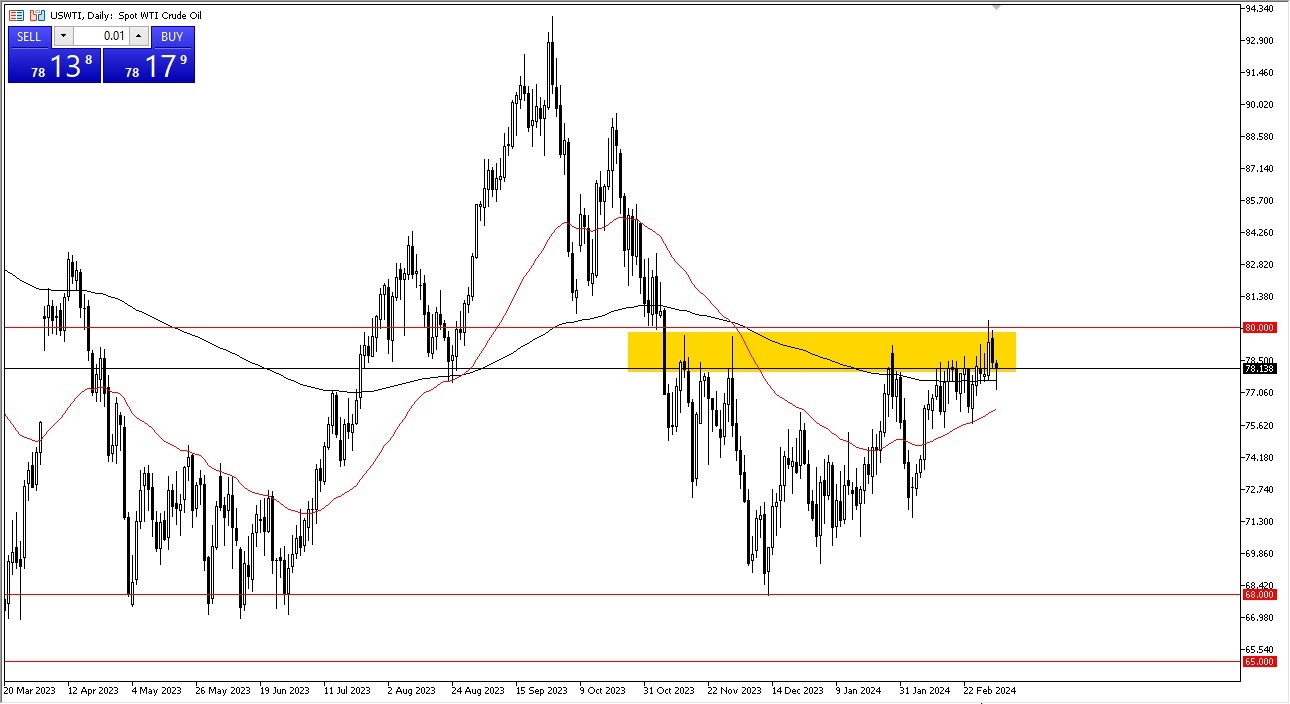

We don’t see any reason to short this market and think that we may go much higher if the WTI market keeps rising and breaks above the $80 level.

- The crude oil markets are still rather agitated, with a drop during Tuesday’s early hours.

- Nevertheless, there is still a lot of support for this market, so I think it will only be a matter of time until we take off to the upside, and this is how I have been approaching this market, in both grades for that matter.

- These markets continue to see volatility more than anything else.

As you can see, crude oil is still declining, but the WTI market is still hovering around the 200-day EMA and is beginning to show some signs of support in this area. Having said that, I believe you need to see this through the lens of a market that is bullish notwithstanding potential turbulence. Since I believe that’s essentially how we’ve been playing the market for a while, I don’t see any reason to short this market and I still think that we may go much higher if the WTI market keeps rising and breaks above the $80 level. That, in my opinion, will happen sooner rather than later.

Forex Brokers We Recommend in Your Region

Naturally, during Tuesday’s trading session, Brent fell a little bit, but the 200-day EMA is now entering the picture and showing indications of support. The $84.50 level is a resistance barrier that we must wait for a close above before we can truly start to see a move if we reverse course and break above the candlestick’s peak.

I believe that given that context, there is a chance that the market might reach the $90 mark. The $95 level is a feasible objective after that. I think a lot of this makes sense because we are approaching the season when oil demand increases, so you have to see it from that perspective. I’m not interested in attempting to overly romanticize this market. All I want to do is find a way to invest in what I believe will be a bull market run this summer. In addition, supply in the physical market has been a little tight, and the futures market will eventually catch up.

I believe that given that context, there is a chance that the market might reach the $90 mark. The $95 level is a feasible objective after that. I think a lot of this makes sense because we are approaching the season when oil demand increases, so you have to see it from that perspective. I’m not interested in attempting to overly romanticize this market. All I want to do is find a way to invest in what I believe will be a bull market run this summer. In addition, supply in the physical market has been a little tight, and the futures market will eventually catch up.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Oil trading brokers in the industry for you.

Read More:Crude Oil Forecast Today 06/03: Tests for Support (Video)

2024-03-06 09:57:10