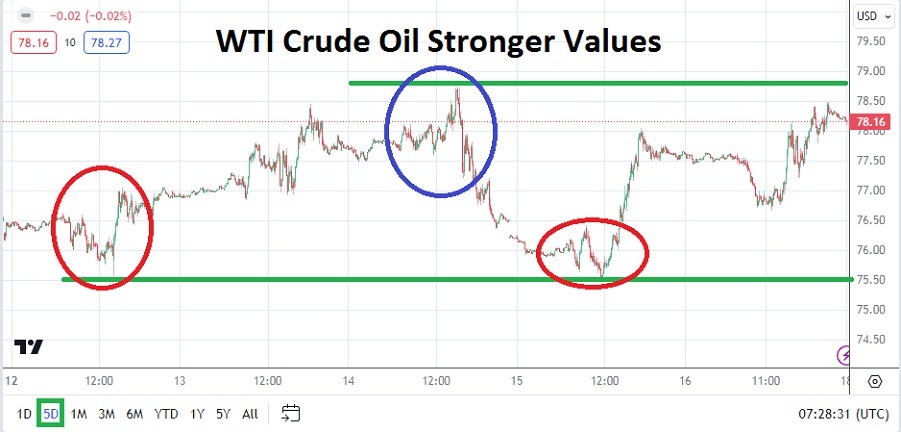

WTI Crude Oil went into the weekend slightly below the highs it achieved during the week of trading, this as the commodity showed durable support and the ability to reverse upwards.

- You will likely read elsewhere this weekend that WTI Crude Oil traded near its higher values due to simmering Middle East tensions.

- However, traders should not give too much credence to this viewpoint.

- WTI Crude Oil went into the weekend above 78.000 USD it is true, which is a solid accomplishment for the commodity.

- And WTI Crude Oil produced rather durable support near the 75.500 USD ratio while trading this past week, having hit the level on Monday and Thursday.

But before traders assume the reason for WTI Crude Oil trading within sight of mid-term highs is due to Middle East tensions increasing, traders should consider the fact that Middle East tensions have been high since the 7th of October. Since October, WTI Crude Oil has seen a high of nearly 90.000 USD on the 18th and 20th of October.

However, since then the highs of the commodity were traversed in mid-October, prices reversed lower. The 80.000 ratio was tested in the middle and the end of November, towards the end of January and the recent past week. It should also be noted importantly that the 79.000 price has actually been the level resistance has produced strength during these listed timeframes.

While there is no doubt Middle East tensions are being considered by large traders and big speculators in the energy sector, the price of WTI Crude Oil is likely being driven the past few weeks by speculative forces and buyers taking advantage of what may be thought of as a relatively good value. Meaning the recent buying of WTI Crude Oil may be happening by those who want to take delivery of a product that is perceived as cheaper now before spring and summer demand could increases prices.

Forex Brokers We Recommend in Your Region

- U.S markets are on holiday tomorrow, WTI Crude Oil futures trading be extremely light until Tuesday.

- The ability to climb off the 75.500 USD price twice this past week is a sign buyers are more active.

- Crude Oil inventories in the U.S per official reports last week showed a massive amount of inventory, which also suggests speculative forces are behind the rise in the cost of the energy recently, this because there is no shortage of product.

Traders should not dismiss the notion that Middle East shipping tensions exists, but they should acknowledge that the crisis in the region has been taking place for a handful of months. It is more likely that speculative forces have been creating the upwards momentum and letting behavioral sentiment create nervousness among some traders who may feel it is dangerous to sell (be short) the commodity near-term. The question is if current resistance levels will start to see push back again and if WTI Crude Oil will start to move lower and challenge support once again.

This will be an interesting week of results for WTI Crude Oil taking into consideration the past three weeks. Those who perceive resistance as durable and a place where reversals will be sparked may want to test the higher technical prices with selling positions. However, recent trading and the ability to go into the weekend near highs is a telltale trading signal there may be nervousness about being short during a long holiday weekend which gives an extra day for developing news to suddenly emerge which could spark more buying. Buying momentum has proven legitimate the past few weeks.

But if the ‘news’ cycle remains quiet this weekend and on Monday, then it will be doubly intriguing to see if WTI Crude Oil can sustain its higher price range. Day traders should be careful as always. If the commodity starts to see selling build velocity on Tuesday, it may be a signal downwards momentum may create some pressure and that lower price elements near the 77.000 to 76.000 will again be tested. If the 76.000 mark is hit and WTI Crude Oil falls below the 75.250 vicinity, lower depths could be explored.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.

Read More:Crude Oil Weekly Forecast – 18/02: WTI Holds Near Highs

2024-02-18 08:46:22