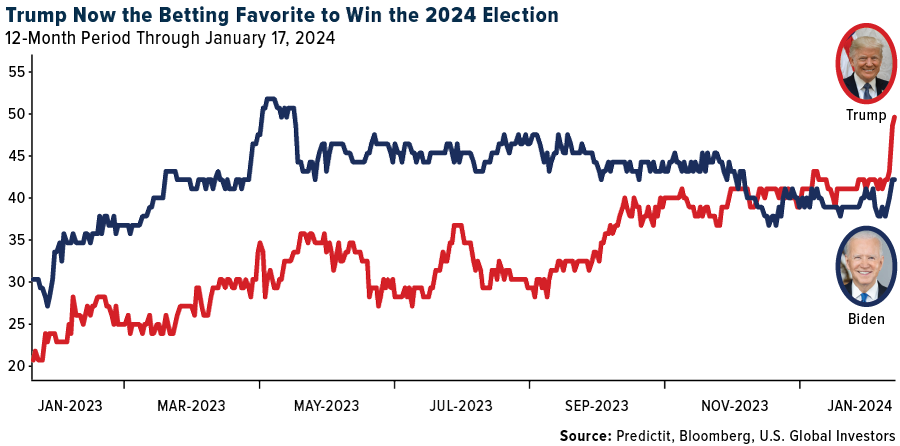

The race for the White House intensified this week as Donald Trump won the Iowa caucus with 51% of the vote, handily beating rivals Ron DeSantis and Nikki Haley. Results from the online prediction market PredictIt now show that Trump has become the betting favorite to win November’s general election.

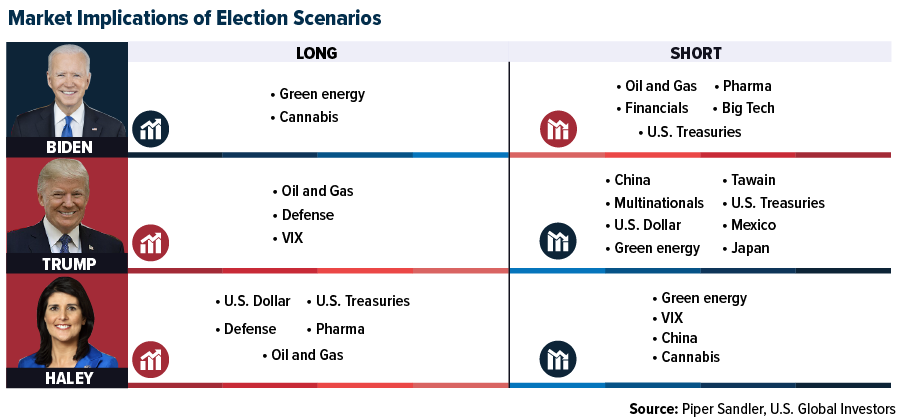

Whether you support the ex-president or not, it’s important for investors to consider the potential market ramifications of a possible second Trump term. One such sector that has come into focus is defense, especially in light of escalating tensions in the Middle East.

Trump vs. Haley’s Military Strategies

In a note to investors this week, Piper Sandler’s head of U.S. policy research, Andy Laperriere, highlighted defense as a sector to watch should Trump or Haley win in November. In fact, Laperriere gives Haley higher marks than Trump when it comes to boosting defense spending, writing that the former South Carolina governor and United Nations ambassador would be “more focused on winning substantive legislative victories in Congress than Trump.”

But then, a second Trump presidency might mean the U.S. pulls out of the North Atlantic Treaty Organization (NATO)—one of Trump’s longstanding priorities—in which case the U.S. would likely need to increase military outlays. The U.S. currently spends about 3.5% of its gross domestic product (GDP) on national defense, which is significantly higher than what most countries spend, but it trails the military buildup of the 1980s, when outlays were closer to 7% and 8% of GDP.

A $1 Trillion Annual Defense Budget?

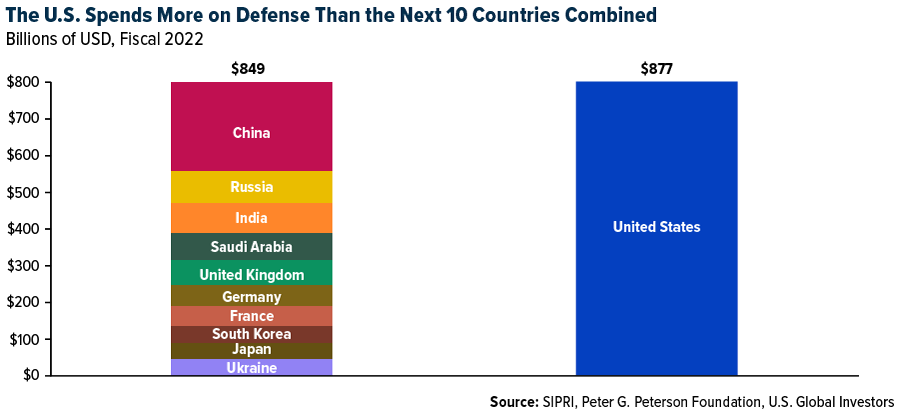

None of this is to suggest that the military has languished under President Joe Biden. The U.S. already outspends the next 10 countries combined, and at the end of last year, the president signed the U.S. defense policy bill, authorizing a record $886 billion in annual military spending.

But with the world’s geopolitical thermostat climbing, it’s easy to see this budget going even higher—even topping $1 trillion. According to U.S. Under Secretary of Defense Mike McCord, that eye-watering dollar amount is “inevitable” within just a few years.

I believe this would carry clearly positive implications for defense stocks, but don’t take it from me. In December, Fitch Ratings raised its outlook of the defense industry, writing that contractors “will be supported by higher backlogs and elevated spending on national security.”

That same month, the Financial Times reviewed the orderbooks of 15 global defense contractors, finding that their combined backlogs in just the first half of 2023 totaled a massive $764 billion.

Governments’ “sustained spending” on defense “has spurred investors’ interest in the sector,” the article reads.

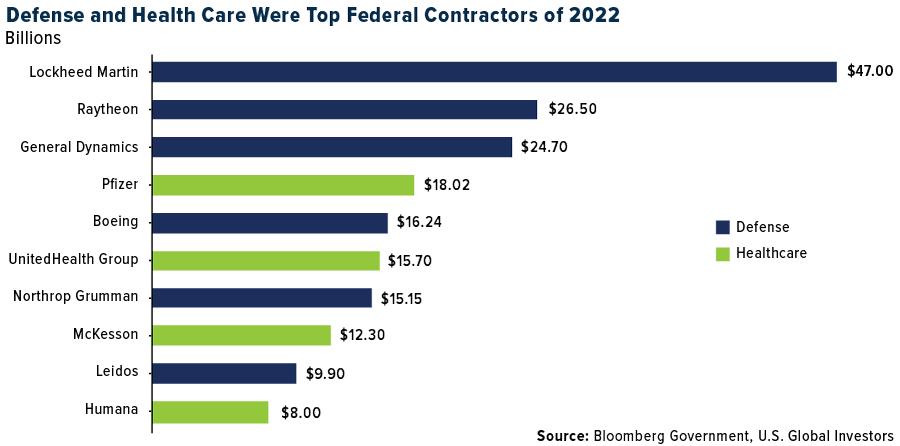

The “Big Five” and Federal Contracts

When evaluating a defense service company and its growth potential, it’s essential to spend time looking at its contract portfolio. Many of these firms have only one buyer—the federal government—which creates a unique market dynamic where competition is often less about price and more about technological and strategic superiority.

Over the years, the “Big Five” defense contractors—Lockheed Martin, RTX, General Dynamics, Boeing and Northrop Grumman—have received about a third of the Defense Department’s annual budget, according to the Congressional Research Service (CRS). 2022 saw a record $705 billion in military contracts, with $47 billion going to Lockheed Martin alone, more than any other company. In fiscal 2024’s military budget, a whopping 58 out of 78 major weapons systems—or roughly three quarters—involve at least one of the Big Five companies as a primary contractor. (In the chart below, please note that Raytheon Technologies rebranded as RTX in June 2023.)

With defense spending constituting a significant portion of the U.S. GDP and an escalating global geopolitical landscape, the 2024 election could indeed be a defining moment for defense stocks.

Investors and market observers alike are keenly watching the unfolding political developments, understanding that the election’s outcome could propel the defense sector to new financial heights.

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 0.72%. The S&P 500 Stock Index rose 1.11%, while the Nasdaq Composite climbed 2.26%. The Russell 2000 small capitalization index lost 0.50% this week.

- The Hang Seng Composite lost 6.03% this week; while Taiwan was up 0.96% and the KOSPI fell 2.07%.

- The 10-year Treasury bond yield rose 18 basis points to 4.129%.

Airlines and Shipping

Strengths

- The best performing airline stock for the week was Southwest Airlines, up 4.90%. According to JPMorgan, not a single material point raised by the court in ruling against the JetBlue/Spirit merger, directly applies to the Alaska deal to buy Hawaiian. Both of these airlines are hybrid models, as noted by the court, so the focus on preserving ultra low-cost competition does not apply.

- Container average spot rates are up 120% since December 1, with Asia-Europe spot rates up 265%. Spot rates should move higher in the coming months as the pre-Chinese New Year demand mini peak coincides with a peak in Red Sea supply disruptions.

- According to Morgan Stanley, Wizz Air agreed with the CAA in July 2023 to make several commitments regarding the handling of claims for costs incurred following flight disruptions. More than 25,000 claims were re-examined, resulting in additional payments in around 6,000 cases. £1.24m has been paid to passengers after enforcement action was taken, according to the CAA. The CAA has conducted checks on a random sample of claims and has confirmed that Wizz Air is fully compliant with the agreement.

Weaknesses

- The worst performing airline stock for the week was Wizz Air, down 9.2%. The Federal Aviation Administration (FAA) is imposing additional requirements on Boeing before its 737 Max 9 aircraft return to service. Moreover, the agency wants to review data from an initial round of docking checks on 40 planes, using Boeing’s instructions before determining whether the measurements are appropriate for the entire fleet of jets on the ground. As a result, the extra overhaul also risks prolonging the plane’s grounding for another week.

- Red Sea vessel transits are currently half of normal with containers seeing the biggest diversions, with current transits only 10% of normal. The data shows bulkers and tankers are starting to divert with Red Sea transits at 70-80% of normal levels in the past week given higher insurance. Bulk and tankers could see more diversion given the threat of Houthi retaliation after Operation Prosperity Guardian attacks last week.

- Judge William Young permanently enjoined JetBlue and Spirit from executing the proposed merger agreed on July 28, 2022, ruling that it violates the Clayton Act. The judge believed entry to backfill Spirit’s capacity is timely and likely, and he viewed it unlikely to be sufficient due to the current industry constraints (aircraft, ATC, and pilots). In turn, permitting JetBlue to acquire Sprit “would eliminate one of the airline industry’s few primary competitors that provides unique innovation and price discipline” and “the merger would likely incentivize JetBlue further to abandon its roots as a maverick, low-cost carrier.”

Opportunities

- According to JPMorgan, LCCs will continue to be a key growth engine of Asia’s aviation market.The dual-brand strategy adopted by various airlines (Cathay Pacific/HK Express, Qantas/Jetstar, etc.) has performed well as they reap synergies and concurrently capture demand for low-cost and premium leisure travel. Based on OAG estimates, the number of airport pairs operated by LCCs has increased fourfold since 2011.

- According to Stifel, Maersk and Hapag-Lloyd will form a new shipping alliance called “Gemini Cooperation” as of February 2025. The new alliance will command a combined capacity of 3.4m TEU of which Maersk will provide 60% and Hapag-Lloyd 40%. The agreement covers seven trade lanes which include the main trade lanes Far East, Transpacific and Transatlantic. It does not cover too much of the North-South trade.

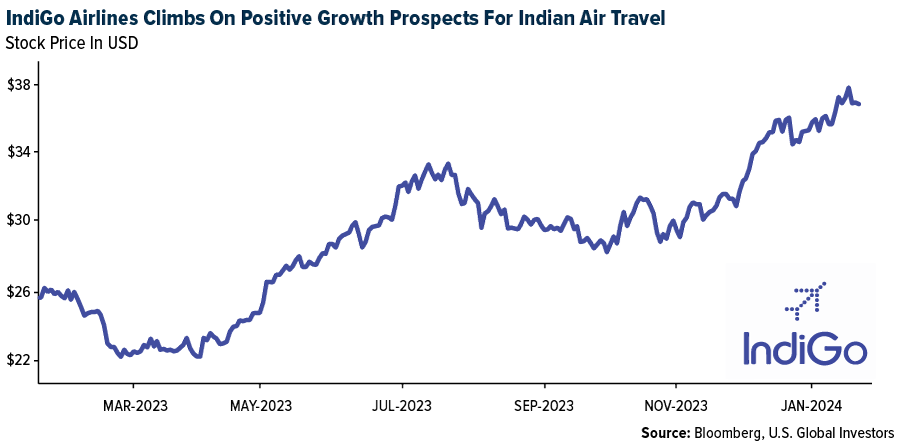

- India’s aviation market is poised to witness rapid growth, says JPMorgan, supported by higher propensity for international travel and rising disposable income. Moreover, India’s improving airport infrastructure and Indian airlines’ capacity injection (via aggressive aircraft purchases) will facilitate this growth. Currently, India accounts for the largest aircraft order backlog worldwide. This growth will require time (5-10 years) to take-off given the challenges, such as aircraft grounding, pilot shortage and infrastructure development.

Threats

- According to Folha, GOL is considering filing for Chapter 11 bankruptcy in the U.S. within a month. According to the report, over the next two weeks, the company will work on a debt restructuring plan out of court, but this seems challenging due to conflicting interests among financial creditors, aircraft lessors, and stakeholders. They state that seeking bankruptcy protection in the U.S. offers more advantages than in Brazil, citing predictable rules and more financing options.

- Reports suggest FedEx is preparing to lose half of its Express business with USPS amid their contract negotiations. In particular, 29 cities’ daytime flying was called out as being at risk of being eliminated. Altogether reports suggest that FedEx will potentially have 200 to 300 more excess pilots by October.

- According to Goldman, Copa Airlines currently operates 21 MAX 9 aircraft with seat configuration which will require further inspections once the FAA guidelines are defined. As a reference, Copa currently operates 106 aircraft and therefore, the announced…

Read More:How the 2024 Election Could Propel Defense Stocks to New Heights

2024-01-20 00:55:24