The FTSE 100 initially pulled back during the course of the trading week but found enough support near the 7360 level to turn things around and show signs of life. At this point, the weekly candlestick is a hammer, and it suggests that we are going to continue to go higher, perhaps reaching the 7700 level above. If we can break above the 7700 level, then it’s likely that we could go reaching to the 7900 level given enough time. It’s also worth noting that the 200-Week EMA underneath has offered significant support as well.

The German DAX has rallied significantly during the trading week, closing just below the recent highs and it looks like we are ready to go much higher. That being said, we are a little overextended so don’t be surprised at all if we get some type of pullback. A pullback should offer value that a lot of people will be willing to take advantage of, with the €15,500 level being a major support level, right along with the 50-week EMA.

The US dollar has fallen rather significantly during the course of the trading week against almost everything, and the Swiss franc was no different. The market has tested the 0.87 level, and it did break down below there just a little bit. All things being equal, the market is likely to continue to see plenty of negative pressure if we continue to see a lot of downward pressure in yields when it comes to the United States. If we do see the bond market continue to see a lot of downward pressure, then I think the Swiss franc will continue to benefit. That being said, look for a short-term bounce that you can start fading on the first signs of exhaustion.

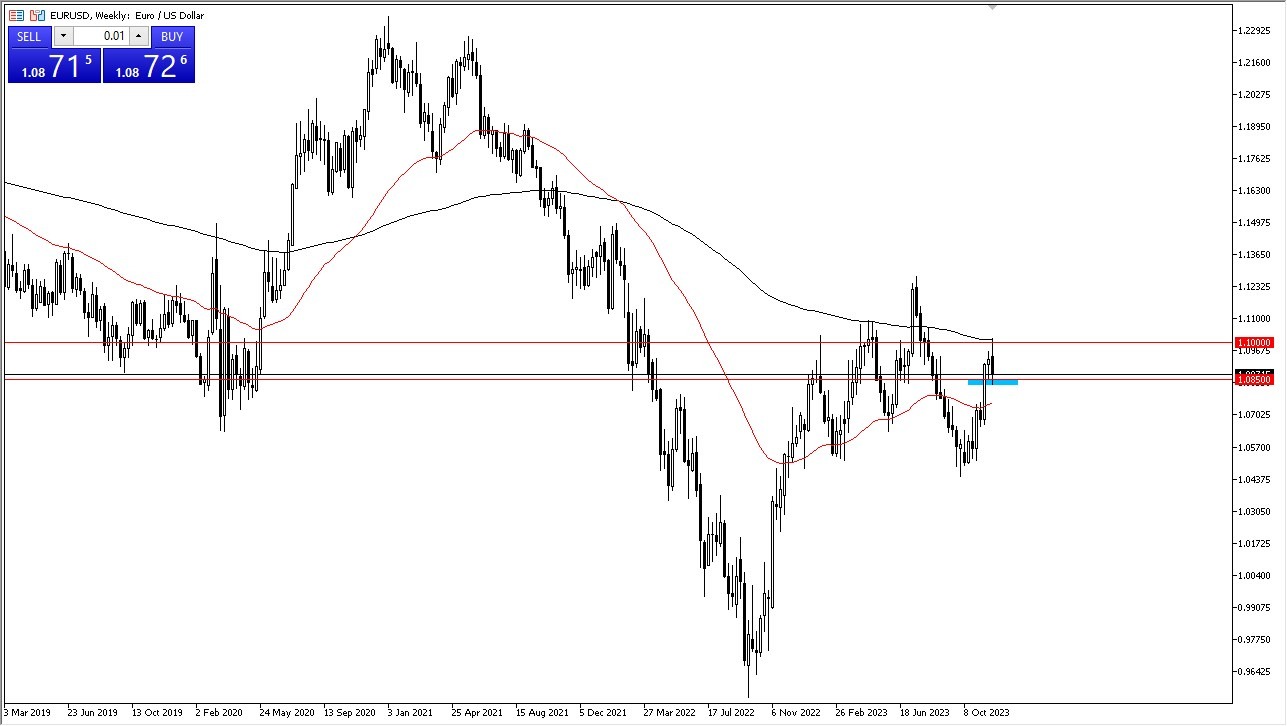

The euro initially tried to rally during the course of the trading week but found the 200-Week EMA near the 1.10 level as a major barrier. By pulling back from that level, it shows that we continue to see a lot of volatility. Underneath, the 1.0850 level is a significant support level that we need to pay close attention to, and therefore I think it’s a situation where we continue to trade in this area, but if we were to break down below the bottom of the candlestick, then it’s possible that we could drive down to the 50-Week EMA. On the other hand, if we were to break above the candlestick for the week, then it opens up the possibility of a move to the 1.1250 level.

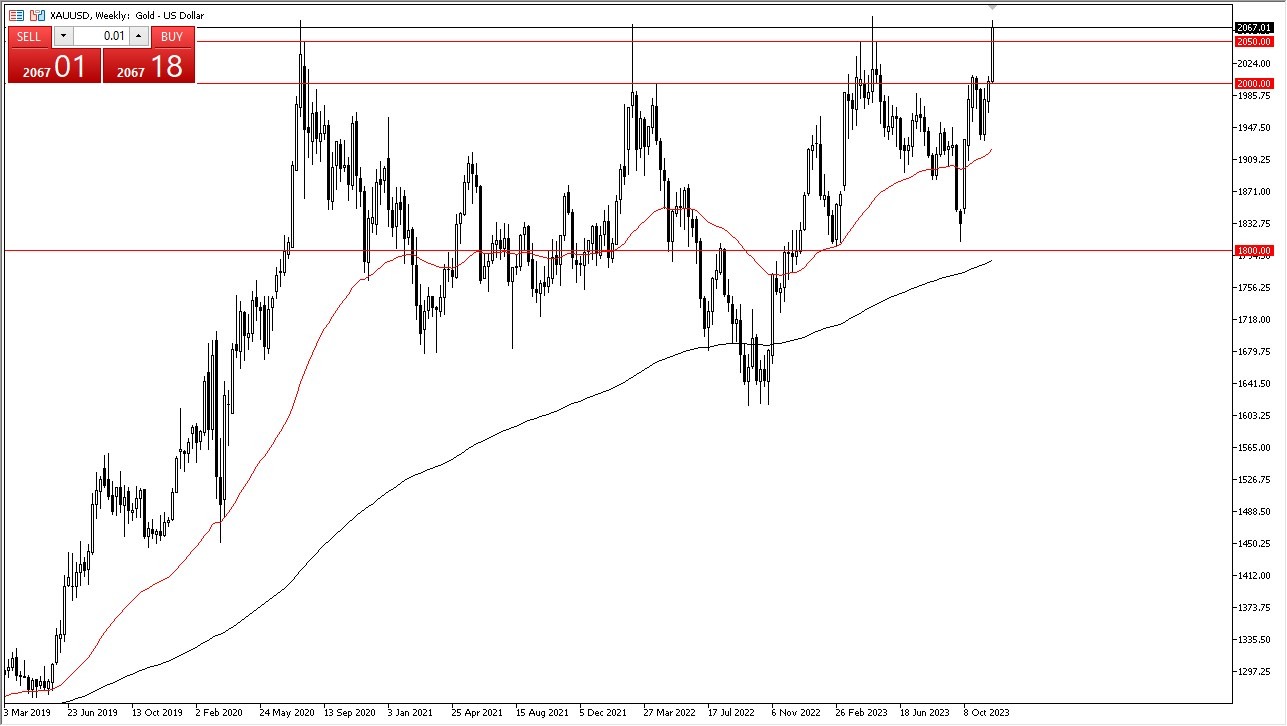

Gold markets have exploded to the upside during the trading week, as we are closing near the recent all-time highs. That being said, it’s probably worth noting that we have seen this area act as a major barrier, so even though it looks very bullish, do not be surprised at all to see if this market drops. If we do drop from here, the $2000 level will be an area that a lot of people will be paid close attention to. I would anticipate that a lot of value hunters would come back into the market in order to take advantage of the move, but if we were to break down below there, then it’s possible that we could drop down to the 50-Week EMA. Ultimately, if we break above the $2080 level, then gold will take off again.

The British pound has rallied during the week, to test the 200-Week EMA. The 200-Week EMA of course is an area that a lot of people would pay attention to, and pulling back from that level could be a sign that we are ready to pull back in order to find buyers. On the other hand, if we break above the 200-Week EMA, then I think the British pound continues to rally. At that point, I would anticipate that the British pound could go looking to the 1.30 level.

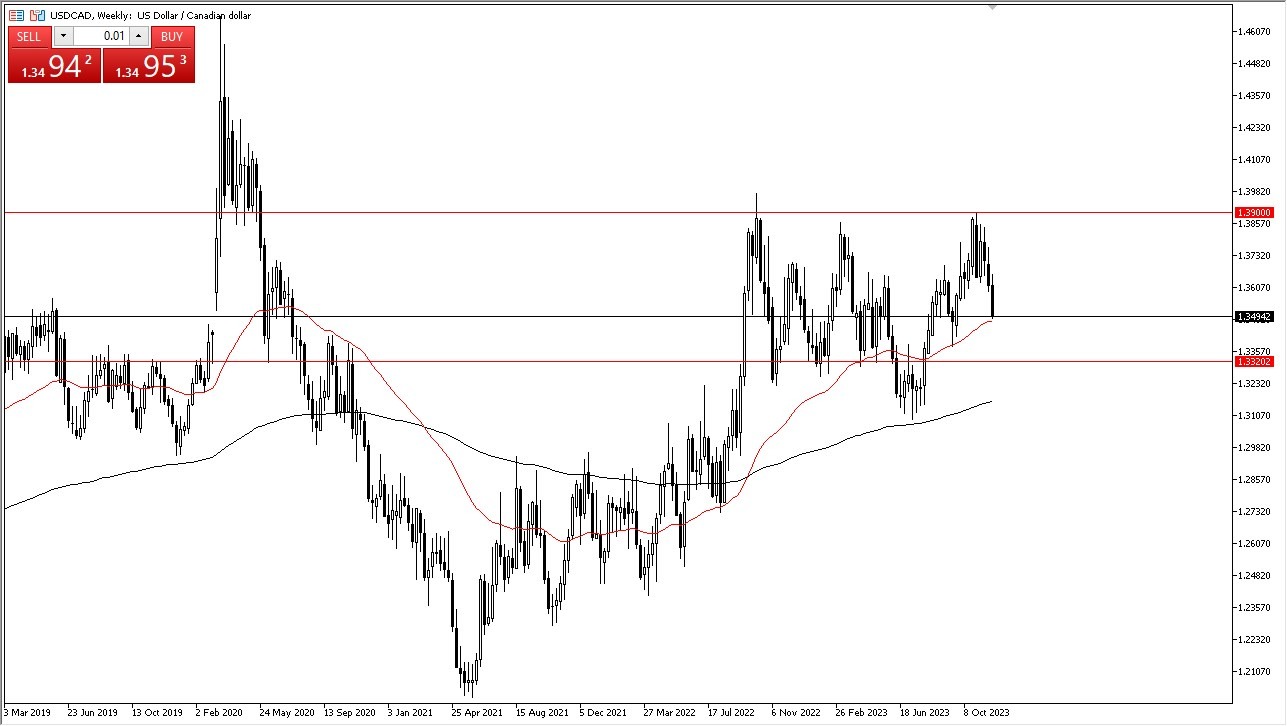

The US dollar initially tried to rally a bit during the trading week, but then fell down to the 1.35 level. The 50-Week EMA underneath offer support, but I think it’s more likely than not going to be a situation where we drop down to the 1.3320 level, an area that has been important previously. The size of the candlestick does suggest that there is plenty of momentum, but we are clearly starting to get oversold on the daily chart, so I think at this point any rally is probably going to give you an opportunity to start buying Canadian dollars again.

The Dow Jones 30 took off to the upside during the course of the week, as it is now well above the 36,000 level. Ultimately, a short-term pullback offers a buying opportunity in a market that has been very bullish for some time. The 35,700 level underneath is significantly supportive from what I can tell, and clearly we are in a time of year that a lot of people rush into the stock market, to kick off the so-called “Santa Claus rally.”

Read More:Pairs in Focus This Week – FTSE 100, DAX, USD/CHF, EUR/USD

2023-12-03 10:20:02