Stock buybacks may be peaking, removing “a potential pillar of support” for earnings per share in 2023, according to RBC Capital Markets.

“The dollar value of share buybacks has been receding, and the percent of companies reducing their share counts on a year-over-year basis has returned to past highs,” said Lori Calvasina, head of U.S. equity strategy at RBC, in a note Monday. “Our earnings model assumes the net share count in the S&P 500 will remain flat” with levels seen in the third quarter through the end of next year, according to her note.

A new tax looms over buybacks, while companies also are facing higher borrowing costs, making funding share purchases with debt more expensive.

“Few are focused at all on a point I brought up last week: corporate buybacks – a major catalyst for the bull market since the Great Financial Crisis – will likely be dramatically reduced going forward because of a new 1% excise tax on them taking effect on Jan. 1, as well as corporations no longer being able to issue almost cost-free debt (like they had been able to for several years) to finance those buybacks,” according to a note Monday from Rick Bensignor, president of Bensignor Investment Strategies.

“That will be a huge bullish element that will be missing going forward,” he wrote.

Buybacks totaled $981.6 billion over the 12 months through September, “down from the record $1.005 trillion posted for the June 2022 period,” according to an emailed note Monday from Howard Silverblatt, a senior index analyst at S&P Dow Jones Indices.

“Buybacks remained top heavy,” he said in the note, pointing to the top 20 companies accounting for 49% of share repurchases in the third quarter.

Apple Inc.

AAPL,

Google parent Alphabet Inc.

GOOGL,

Meta Platforms Inc.

META,

Microsoft Corp

MSFT,

and Exxon Mobil Corp., Procter & Gamble Co.

PG,

Lowe’s Cos.

LOW,

Marathon Petroleum Corp.

MPC,

and Nvidia Corp.

NVDA,

and Chevron Corp.

CVX,

ranked as the top 10 companies for buyback volume over that period, his note shows. Oil and gas producer Exxon Mobil

XOM,

returned to the top five for the first time since the third quarter of 2014, he said.

Energy is by far the S&P 500’s best-performing sector this year, soaring around 52% based on Monday morning trading, according to FactSet data, at last check. All the other S&P 500 sectors were showing year-to-date losses, with the broad index down more than 19% so far this year.

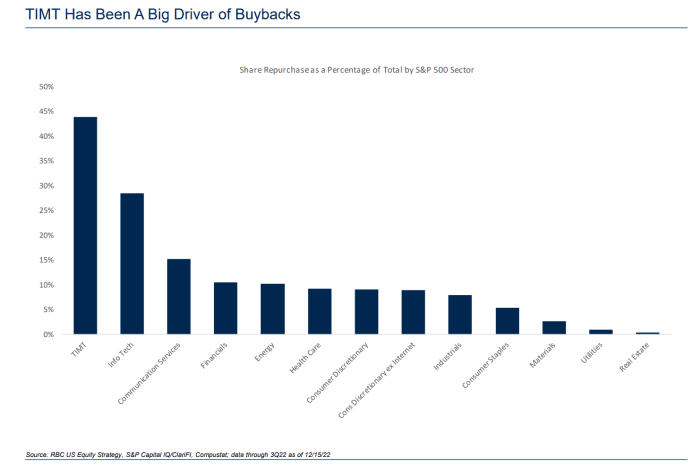

“Digging down a bit deeper, for most major sectors the percent of companies reducing their share counts on a year-over-year basis is near past highs or starting to ease from them,” said RBC’s Calvasina.

And with companies in the area of technology, internet, media and telecommunications — or TIMT — under pressure, “we think it’s tough to paint a rosy picture for share buyback activity over the course of the next year,” she said.

RBC CAPITAL MARKETS NOTE DATED DEC. 19, 2022

“We’ve said in the past that buybacks represent a source of upside to our EPS forecast, but now see this issue as more of a source of downside risk to EPS in coming years,” she wrote, referring to earnings per share.

Stocks have tumbled in 2022 as the Federal Reserve raises interest rates to combat still high inflation and investors worry the Fed’s aggressive monetary policy risks tipping the U.S. into a recession next year.

U.S. stocks were trading down Monday afternoon, with the S&P 500

SPX,

off 0.6%, the Dow Jones Industrial Average

DJIA,

dipping 0.3% and the technology-heavy Nasdaq Composite

COMP,

dropping 1.2%, FactSet data show, at last check.

Read More:Receding share buybacks imperil ‘pillar of support’ for U.S. stock market in 2023

2022-12-19 18:01:00